Despite strong corporate earnings, stock prices closed lower after a volatile week of trading triggered by unprecedented activity in a handful of companies.

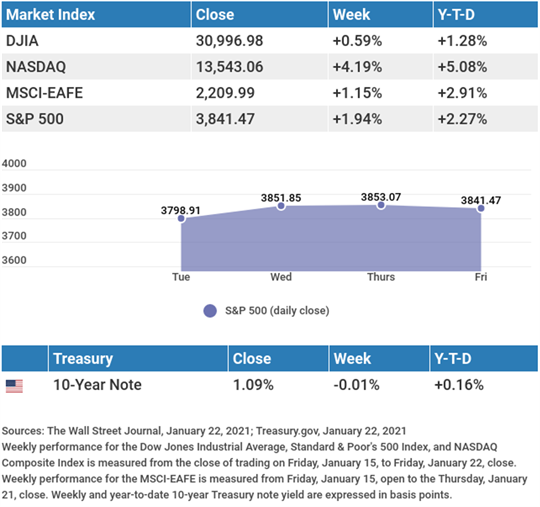

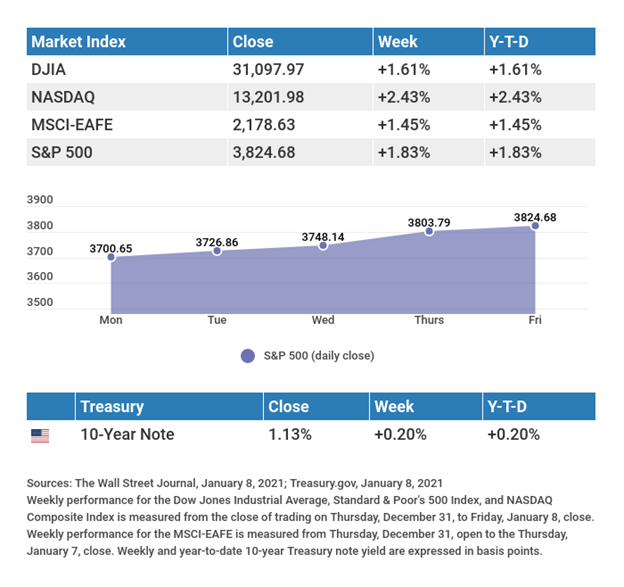

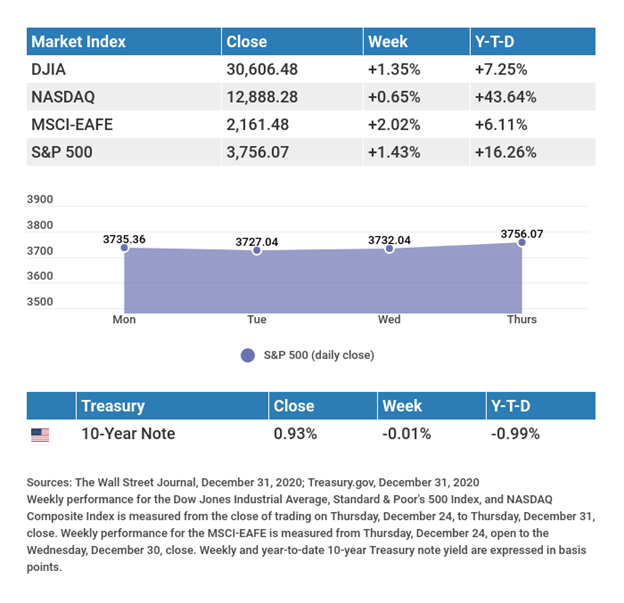

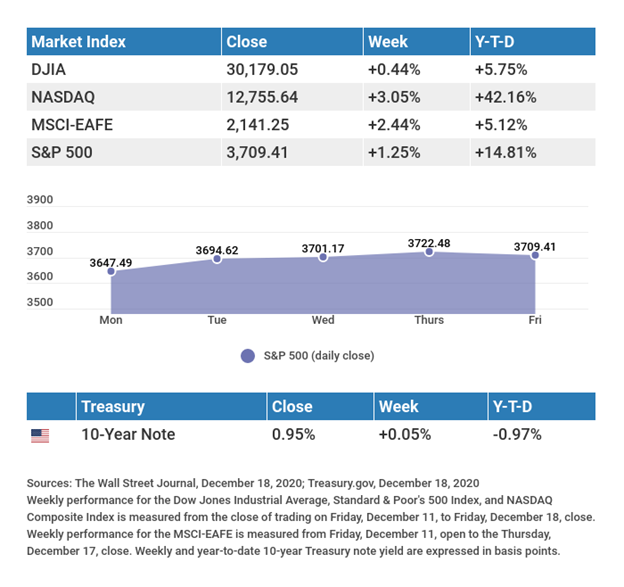

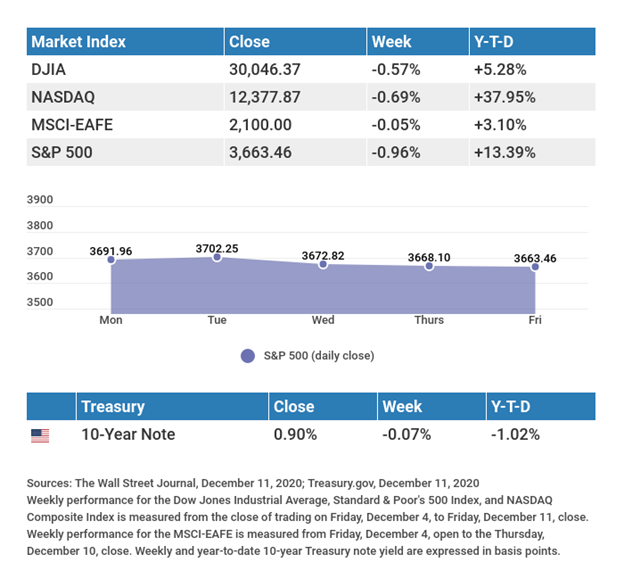

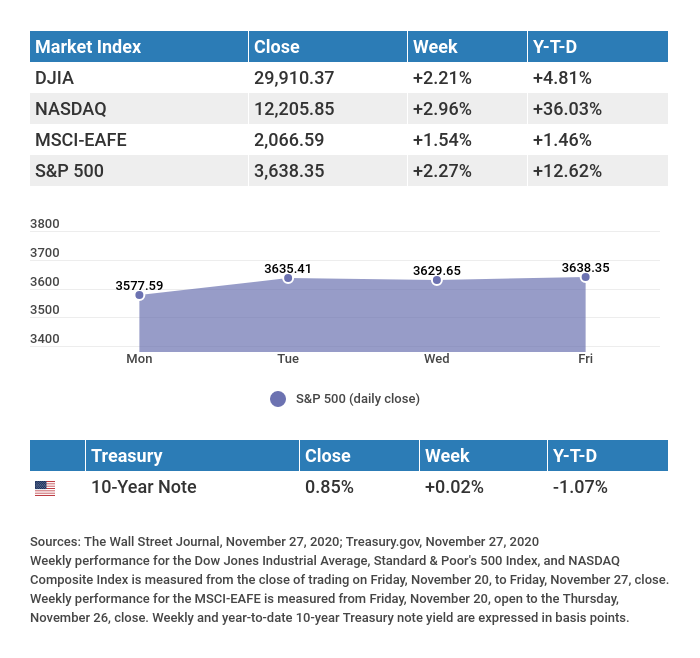

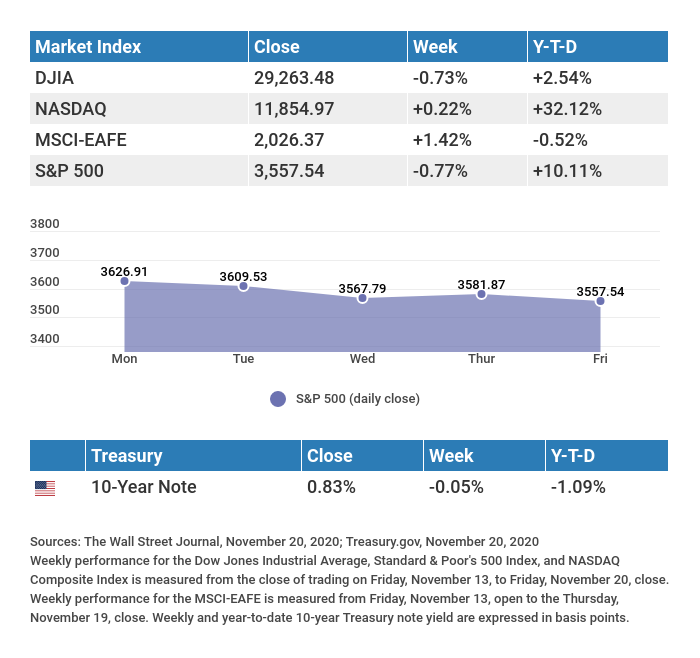

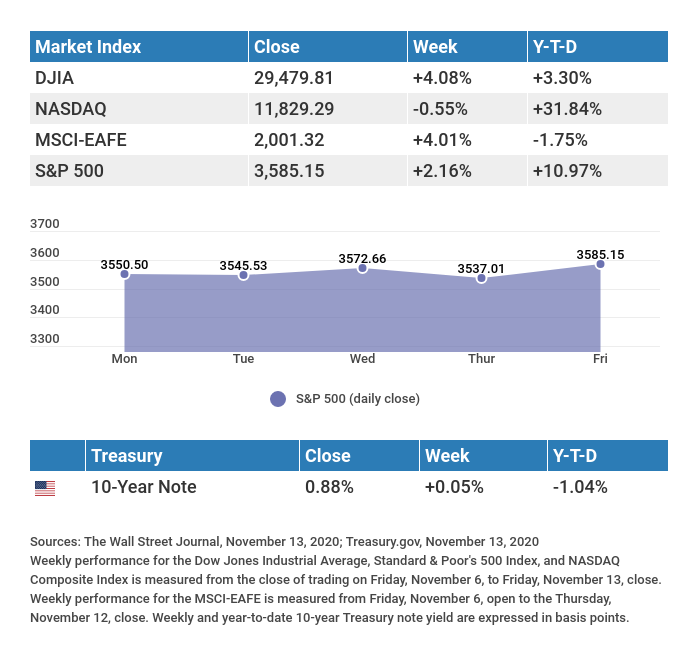

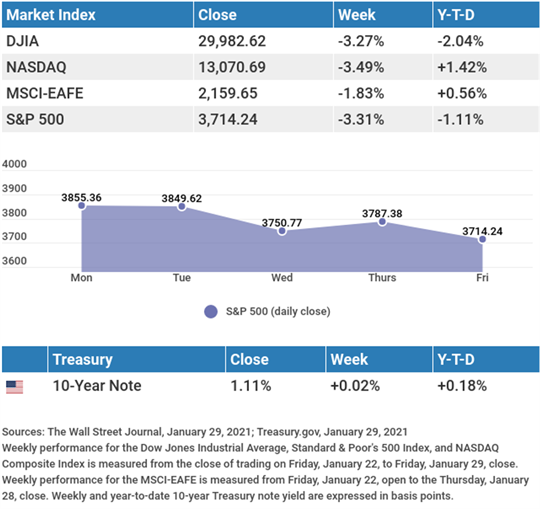

The Dow Jones Industrial Average lost 3.27%, while the Standard & Poor’s 500 fell 3.31%. The Nasdaq Composite index dropped 3.49% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, slipped 1.83%.1,2,3

Bull Market Takes a Breather

On Monday, the S&P 500 and NASDAQ Composite overcame early losses to post new all-time highs.4

Stocks rode a roller coaster on Wednesday, falling sharply despite above-consensus earnings results, only to come roaring back the following day. Stocks suffered another broad retreat on Friday, sending the major indices to their worst weekly performance since October.4,5

Earnings continued to surprise to the upside, with 81% of companies in the S&P 500 that reported results by last Thursday morning exceeding analysts’ expectations.6

Shorts Come Into Focus

The ability of social media to stoke passions and provide a catalyst to herd behavior made itself evident on Wall Street last week.

A chat forum became the central hub for motivating individual investors to trade certain stocks with large short positions. This unexpected buying activity roiled markets and fueled a sharp rise in their stock prices. The sudden surge higher forced some fund managers to buy stocks in these companies at higher prices, resulting in substantial losses for the firms.

It’s difficult to say whether this social media phenomenon has long-term implications, though it is likely to change how professional investors evaluate trading strategies in the future.

In order to sell short, you are required to open a margin account. Selling short is not suitable for all investors. Margin trading entails greater risk, including the risk of unlimited losses in a position and incurrence of margin interest debt. You should consider your financial situation and risk tolerance before trading on margin.

Robert Roman

CEO, Managing Director

THIS WEEK: KEY ECONOMIC DATA

Monday: Institute for Supply Management (ISM) Manufacturing Index.

Wednesday: Automated Data Processing (ADP) Employment Report. Institute for Supply Management (ISM) Services Index.

Thursday: Jobless Claims. Factory Orders.

Friday: Employment Situation Report.

Source: Econoday, January 29, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Monday: Thermo Fisher Scientific, Inc. (TMO).

Tuesday: Amazon.com (AMZN), Alibaba Group (BABA), Alphabet, Inc.(GOOG), ExxonMobil (XOM), Pfizer (PFE), Amgen (AMGN), United ParcelService, Inc. (UPS), Electronic Arts (EA), Emerson Electric (EMR),Chipotle Mexican Grill (CMG).

Wednesday: Abbvie (ABBV), Qualcomm (QCOM), PayPal Holdings (PYPL), GlaxoSmithKline (GSK).

Thursday: Ford Motor Company (F), Bristol Myers Squibb (BMY), Merck (MRK), Snap, Inc. (SNAP), Prudential Financial (PRU), Air Products and Chemicals, Inc. (APD), Penn National Gaming (PENN).

Friday: Regeneron Pharmaceuticals, Inc. (REGN), Illinois Tool Works, Inc. (ITW).

Source: Zacks, January 22, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“They who sing through the summer must dance in the winter.”

– Italian Proverb

Taking A Side Gig? Here’s How It May Affect Your Taxes

Taxpayers who work in the gig economy may benefit from having a better understanding of how their work affects their taxes.

What exactly is the gig economy? The gig economy also is referred to as the on-demand, sharing, or access economy. People involved in the gig economy earn income as a freelancer, independent worker, or employee. They use technology to provide goods or services. This includes activities like renting out a home or spare bedroom and providing car rides.

Here are some things taxpayers should know about the gig economy and taxes:

- Money earned through this work may be taxable.

- There are tax implications for both the company providing the platform and the individual performing the services.

This income may be taxable even if the taxpayer providing the service doesn’t receive a Form 1099-MISC, Form 1099-K, or Form W-2. This income may also be taxable if the activity is only part-time or a side work, or if you’re paid in cash.

* This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov7

Show Your Heart Some Love

February is American Heart Month. Heart disease is the number one killer of men and women in the U.S., accounting for 25% of all deaths. While genetics and family history are primary risk factors of disease development and survival, some lifestyle factors are associated with better heart health. But first, make sure to discuss any medical concerns with your health care provider before beginning any dietary and fitness regimen. The following information is not a substitute for medical advice:

- Manage your blood pressure: Make sure to get your blood pressure checked regularly. Hypertension is often asymptomatic.

- Maintain a healthy weight: Being overweight or obese may increase disease risk.

- Eat well and exercise: These two activities are associated with a lower incidence of heart diseases.

- Drink less alcohol and don’t smoke: These habits are seen more frequently in heart disease patients.

- Sleep well and reduce stress: Lower cortisol levels may reduce your risk for heart diseases.

While not all risk factors are controllable, some are. The list above is not comprehensive. Give your heart some love this month and talk to your doctor about the best ways to care for it.

Tip adapted from MedlinePlus.gov8

It can certainly be measured, yet it has no length, width, or height. What is it?

Last week’s riddle: A man claims he was 88 years old two days ago, and yet he also tells you that he will turn 91 next year. How can this be? Answer: The man talks to you on New Year’s Day (1/1), and his birthday is on December 31. So two days ago (12/30), he was 88. On 12/31, he turned 89. His 90th birthday will fall on 12/31 of this year, and he will turn 91 next year.

Footnotes and Sources

- The Wall Street Journal, January 29, 2021

- The Wall Street Journal, January 29, 2021

- The Wall Street Journal, January 29, 2021

- The Wall Street Journal, January 25, 2021

- CNBC, January 29, 2021

- The Wall Street Journal, January, 28, 2021

- IRS.gov, January 22, 2020

- MedlinePlus.gov, October 21, 2020

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2021 FMG Suite.