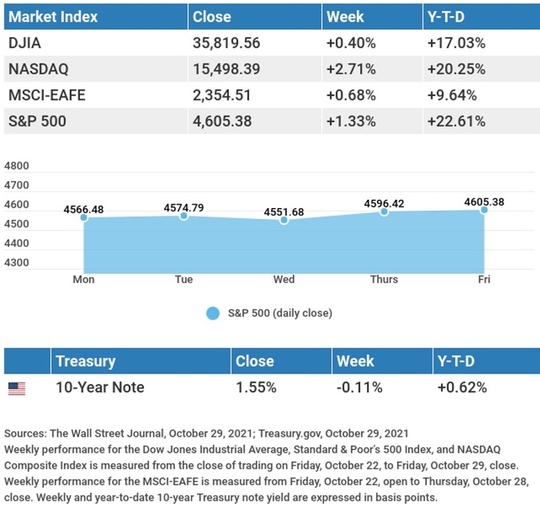

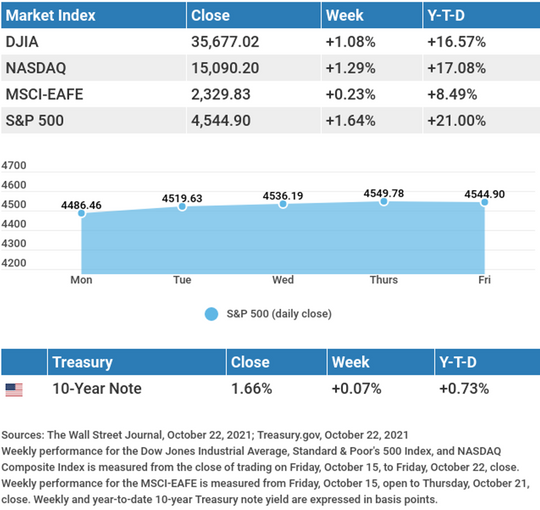

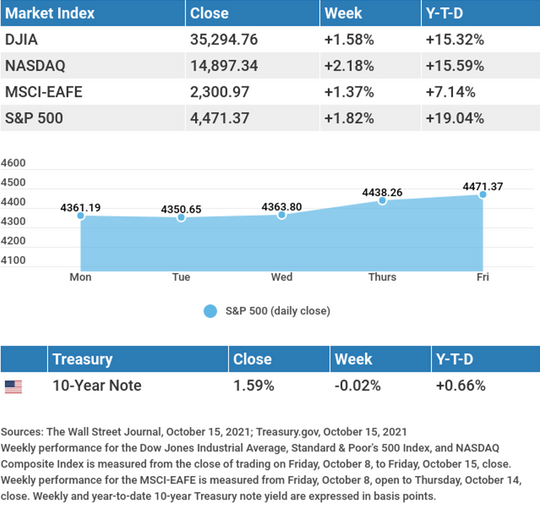

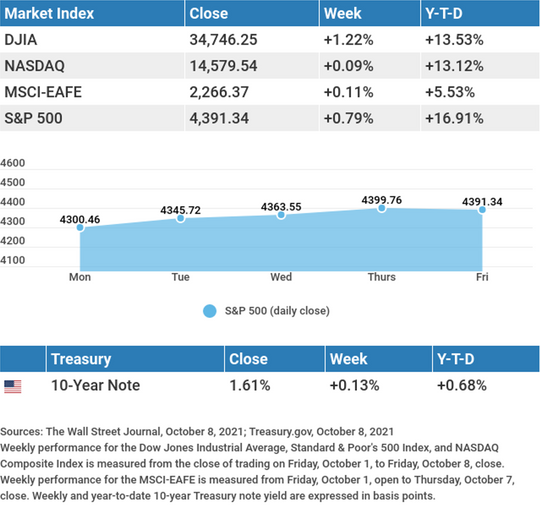

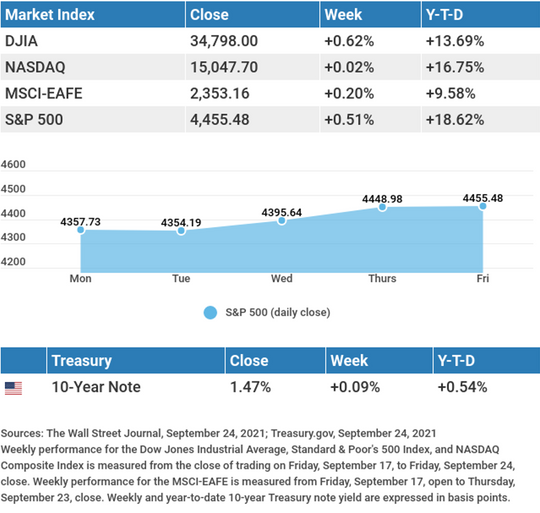

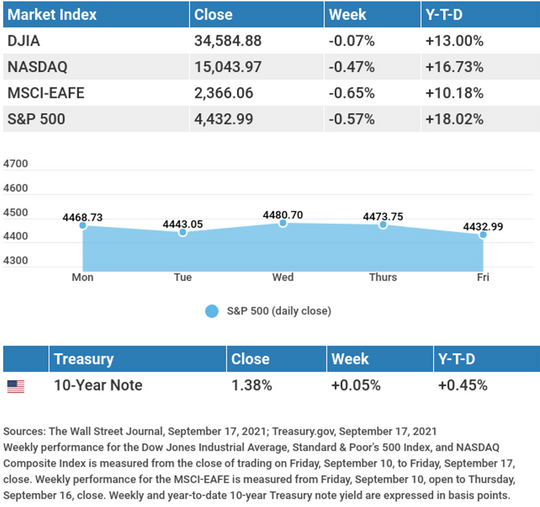

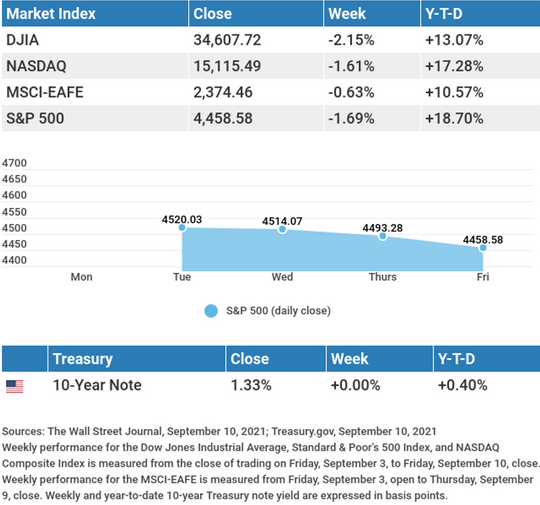

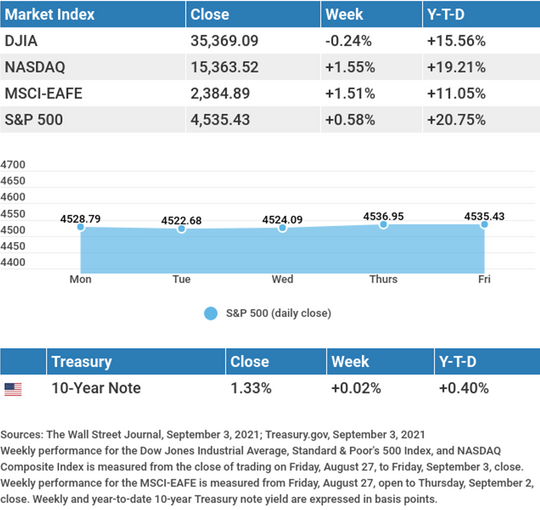

A Federal Reserve announcement on tapering, a fresh batch of corporate profits, and encouraging economic data lifted stocks to another weekly gain.

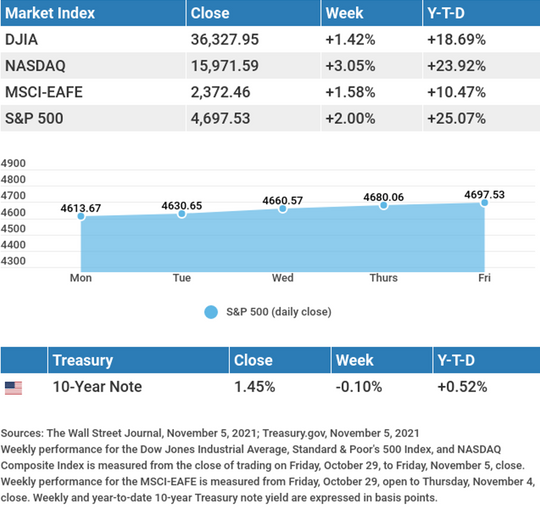

The Dow Jones Industrial Average rose 1.42%, while the Standard & Poor’s 500 advanced 2.00%. The Nasdaq Composite index led, tacking on 3.05%. The MSCI EAFE index, which tracks developed overseas stock markets, added 1.58%.1,2,3

Stocks Power Higher

Stocks marched higher throughout the week, lifted by a succession of positive corporate earnings surprises, optimistic forward guidance by some companies, and healthy economic data. Continued strong third-quarter profits reinforced the narrative that businesses were able to meet strong consumer demand and maintain robust profit margins, despite the headwinds of inflation and supply-chain knots.

Investors were unfazed by the Fed’s mid-week announcement that it would begin its bond purchase tapering plans, in part, because it had long been telegraphed and Fed Chair Powell’s optimistic analysis of the current state of the economy. Also cheered was the announcement of a new COVID-19 antiviral pill and a powerful rebound in job creation, driving stocks to new heights to close out the week.

The Fed Speaks

In an eagerly awaited November meeting of the FOMC (Federal Open Market Committee), the Fed pulled the trigger on its plan to taper monthly bond purchases. Fed tapering will begin this month with reductions of $15 billion per month ($10 billion in Treasurys and $5 billion in mortgage-backed securities) that will end this pandemic-era policy response by July 2022.4

The Fed reiterated its belief that inflation remained transitory, though conceding it had underestimated its acceleration and persistence; it did not expect interest rates to be raised until after the completion of the tapering program. Powell expects inflation to stay elevated until mid-2022 when he anticipates supply-chain bottlenecks to clear.5,6

Robert Roman

CEO, Managing Director

Louis Barajas

Partner

THIS WEEK: KEY ECONOMIC DATA

Wednesday: Consumer Price Index (CPI). Jobless Claims.

Friday: Consumer Sentiment. Job Openings and Labor Turnover Survey (JOLTS).

Source: Econoday, November 5, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Monday: PayPal Holdings, Inc. (PYPL).

Tuesday: D.R. Horton, Inc. (DHI), Sysco Corporation (SYY), Palantir Technologies, Inc. (PLTR), DoorDash, Inc. (DASH), Coinbase Global, Inc. (COIN), Roblox Corporation (RBLX).

Wednesday: The Walt Disney Company (DIS), Affirm Holdings, Inc. (AFRM).

Friday: AstraZeneca PLC (AZN).

Source: Zacks, November 5, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“A career is born in public, talent in privacy.”

– Marilyn Monroe

Check Your Withholding Status Online

The Withholding Calculator can help you determine whether you should submit a new W-4 to your employer, and you also can use the results to adjust your income tax withholding. If you have a more complex tax situation, you may need to use Publication 505, Tax Withholding and Estimated Tax form. This form can help you determine your self-employment tax, alternative minimum tax, or tax on unearned income by dependents. Publication 505 also can help if you receive non-wage income, including capital gains, royalties, dividends, and more.

It’s important to check your withholding to ensure that you’re deducting the right amount of taxes, and these handy tools can help.

* This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov7

Low-Impact Exercises for Healthy Joints

Here are some of our favorite low-impact exercises:

- Swimming – Not only is swimming a low-impact exercise, but it’s also a full body workout. Hop in the pool and do some laps or just splash around for fun. Either way, it’s great for exercising and staying cool.

- Kickboxing – It sounds intense, but kickboxing is actually a low-impact exercise that’s easy on your joints. If possible, modify your workout to focus more on the sport’s cardio movements and not the combat aspect.

- TRX Exercises – The TRX strap is what you often see hanging from a bar at the gym. This simple accessory makes it easy to do lunges, pullups, pushups, and squats without putting pressure on your joints.

- Cycling – Cycling, either indoors or outdoors, is a great exercise and easy on your knees.

Tip adapted from Healthline8

Complete these words by putting the same three letters into each one: F—RISH, C—DY, S—GH.

Last week’s riddle: By rearranging the letters in the phrase VIEWING A STIR, you can make the name of a U.S. state. What state is it? Answer: West Virginia.

Taughannock Falls State Park, Trumansburg, New York.

Footnotes and Sources

1. The Wall Street Journal, November 5, 2021

2. The Wall Street Journal, November 5, 2021

3. The Wall Street Journal, November 5, 2021

4. CNBC, November 3, 2021

5. CNBC, November 3, 2021

6. CNBC, November 3, 2021

7. IRS.gov, January 22, 2021

8. healthline.com, June 24, 2021

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2021 FMG Suite.