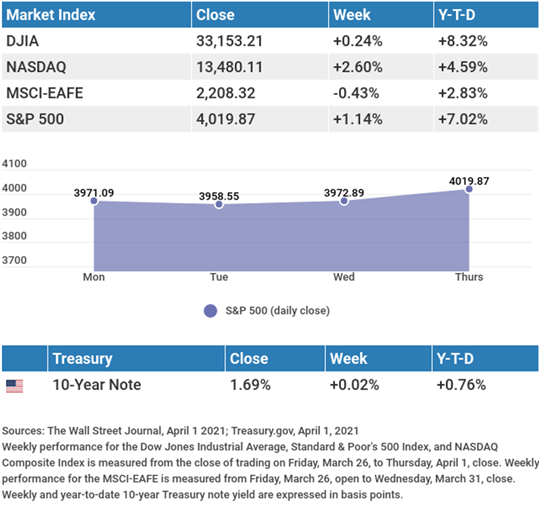

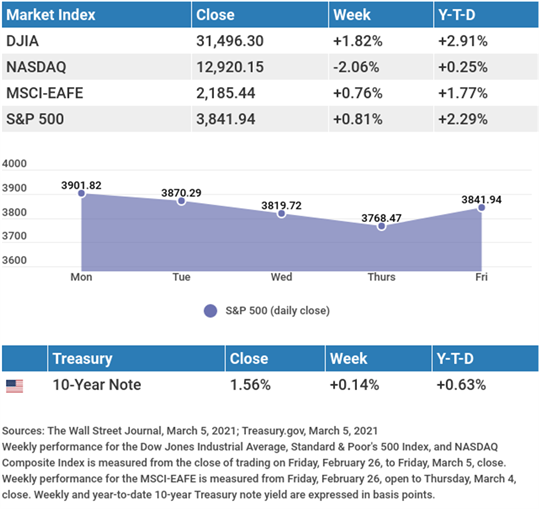

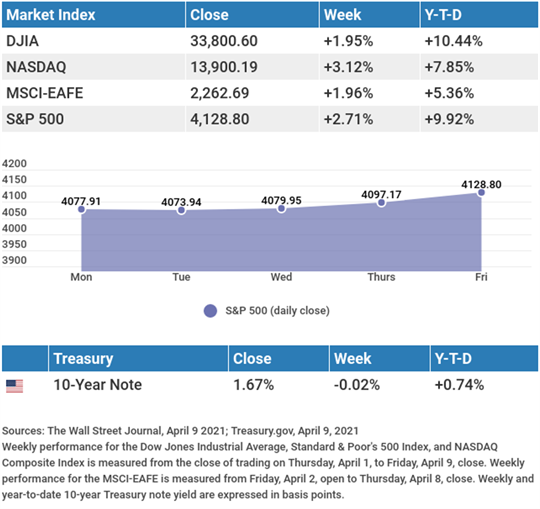

Strong economic data and a resurgent technology sector propelled stocks to solid gains last week.

The Dow Jones Industrial Average advanced 1.95%, while the Standard & Poor’s 500 picked up 2.71%. The tech-heavy Nasdaq Composite index gained 3.12%. The MSCI EAFE index, which tracks developed overseas stock markets, gained 1.96%.1,2,3

Technology Leads

A blow-out jobs report and an all-time high in the ISM-Services Index, coupled with the continued rebound in technology stocks, powered the Dow Industrials and S&P 500 to record highs to open a new week of trading.4

After taking a breather mid-week, stocks resumed their climb amid lower bond yields, widening momentum in vaccination efforts, and falling concerns over corporate tax rate hikes. As bond yields settled lower, technology shares rallied, lifting the S&P 500 to another record high on Thursday, its 19th closing record high this year.5

Despite a surge in March producer prices, stocks added to their gains to close out a strong week of performance.6

Two Steps Forward, One Step Back

The labor market has been perhaps one of the more tenuous ingredients in the budding economic recovery, though recent employment data may suggest the labor market recovery is gathering steam.

March’s employment report exceeded all expectations, posting an increase of 916,000 in nonfarm payrolls, with upward revisions of 156,000 jobs to the January and February increases. Later, the JOLTS (Job Openings and Labor Turnover Survey) report saw a jump in job openings at a level not seen in two years. The weekly new jobless claims report, however, was mixed, as jobless claims came in higher than estimated, while continuing claims fell below the level seen just prior to the wave of pandemic-induced layoffs in late March 2020.7,8,9

Robert Roman

CEO, Managing Director

THIS WEEK: KEY ECONOMIC DATA

Tuesday: Consumer Price Index (CPI).

Wednesday: Federal Open Market Committee (FOMC) Minutes.

Thursday: Jobless Claims. Retail Sales. Industrial Production.

Friday: Housing Starts. Consumer Sentiment.

Source: Econoday, April 9, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Wednesday: J.P. MorganChase (JPM), Goldman Sachs (GS), Wells Fargo (WFC).

Thursday: Bank of America (BAC), UnitedHealthcare Group (UNH), Citigroup (C), Alcoa (AA), BlackRock, Inc. (BLK), Taiwan Semiconductor (TSM), J.B. Hunt Transportation (JBHT).

Friday: Morgan Stanley (MS), PNC Financial Services Group (PNC), PPG Industries (PPG).

Source: Zacks, April 9, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“Anything you don’t understand is dangerous until you do understand it.”

– Larry Niven

Can You Claim the Child Tax Credit for Other Dependents?

Even though you may not be able to claim the child tax credit, you may be able to claim the credit for other dependents under your care. The IRS issues a max of $500 for each dependent who meets specific conditions.

These conditions include:

- Dependents who are age 17 or older.

- Dependents who have individual taxpayer identification numbers.

- Dependent parents or other qualifying relatives supported by the taxpayer.

- Dependents living with the taxpayer who aren’t related to the taxpayer.

The credit begins to phase out when the taxpayer’s income is more than $200,000. This phaseout begins for married couples filing a joint tax return at $400,000.

Taxpayers may be able to claim this credit if:

- They claim the person as a dependent on the taxpayer’s return.

- They cannot use the dependent to claim the child tax credit or additional child tax credit.

- The dependent is a U.S. citizen, national, or resident alien.

This dependent credit may also be able to be combined with the child and dependent care credit and the earned income credit.

* This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov10

Channel Your Natural Beauty

What you put on your body is just as important as what you put in your body. This is why more people are choosing natural skincare and beauty products. Natural ingredients are better for the environment and often gentler on your skin.

When looking for a natural beauty product, check its certifications. Most natural beauty products are certified organic or natural by outside organizations. As an added bonus, they can also be vegan or cruelty-free. You should also consider shopping for products that are non-toxic, palm oil-free, and produced with ethical ingredient sourcing policies and environmentally-friendly packaging.

Here are some of the most common natural ingredients to look for, depending on the product and your needs:

- Aloe Vera

- Almond Oil

- Shea Butter

- Coconut Oil

- Antioxidants like Pomegranate or Orange Extract

- Rosehip Oil

- Sunflower Seed Oil

The list of powerful, effective, and safe natural beauty ingredients is always growing and we are moving toward a future of gentle, sustainable beauty products.

Tip adapted from Sustainable Jungle11

Ian bought a bag of apples on Friday and ate a third of them. On Saturday he ate half of the remaining apples. On Sunday he looked in the bag and found that just two apples were left. How many apples were originally in the bag?

Last week’s riddle: What can be seen in the middle of March and April, that can’t be seen in the beginning or end of either month? Answer: The letter “R.”

Footnotes and Sources

1. The Wall Street Journal, April 9, 2021

2. The Wall Street Journal, April 9, 2021

3. The Wall Street Journal, April 9, 2021

4. CNBC, April 5, 2021

5. The Wall Street Journal, April 8, 2021

6. FoxBusiness.com, April 9, 2021

7. CNBC, April 2, 2021

8. Reuters, April 6, 2021

9. CNBC, April 8, 2021

10. IRS.gov, February 11, 2021

11. Sustainablejungle.com, 2021

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2021 FMG Suite.