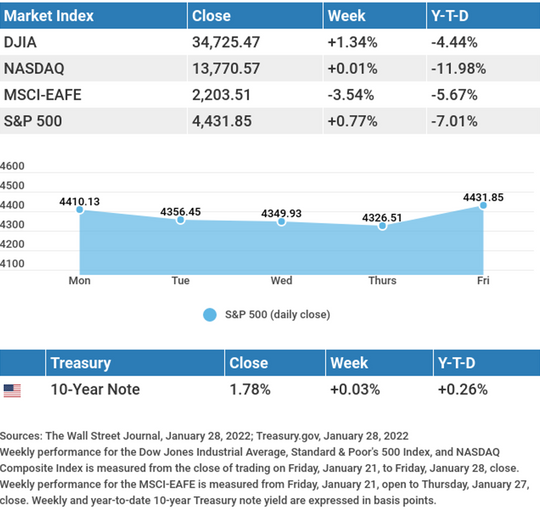

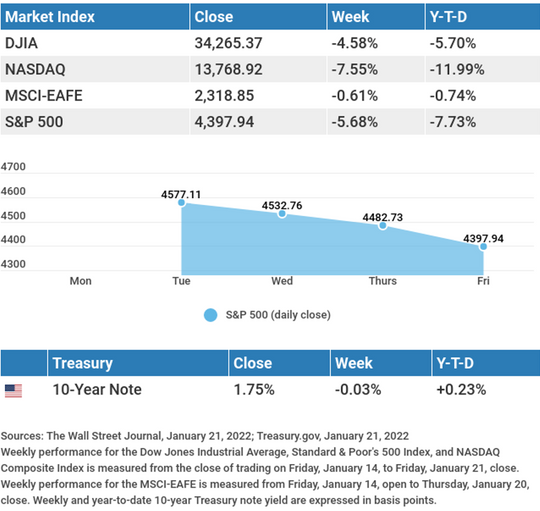

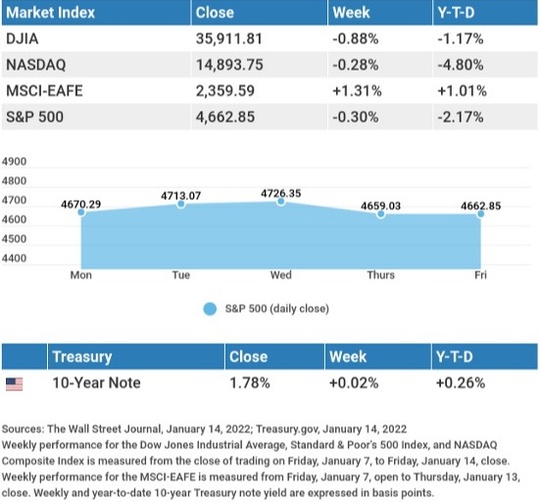

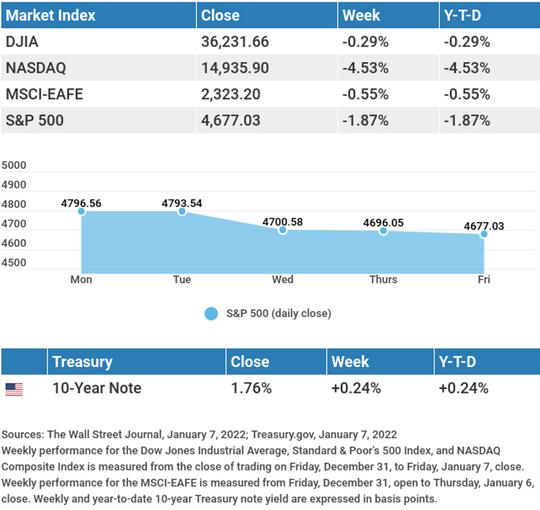

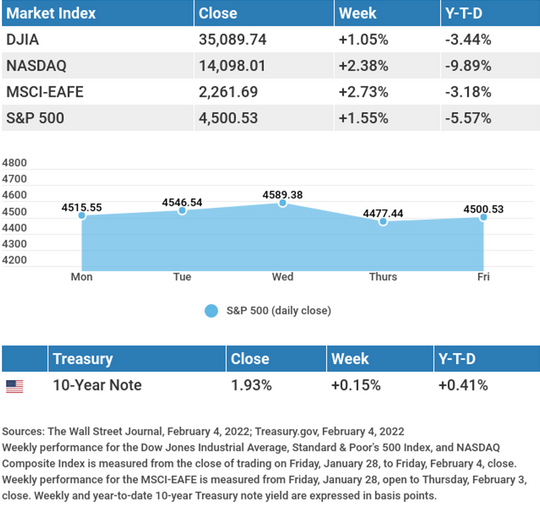

Stocks managed to gain ground last week as investors turned their focus to corporate earnings.

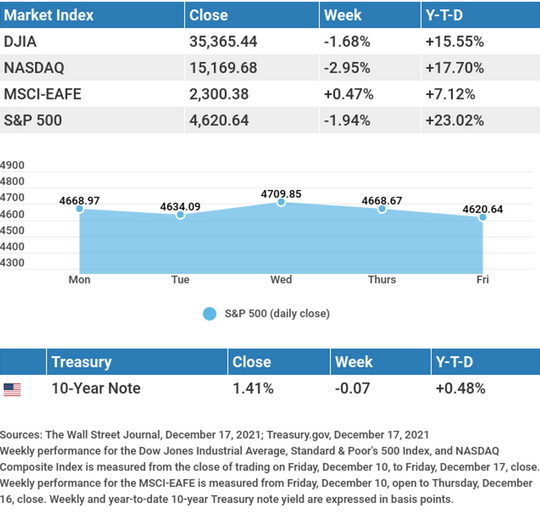

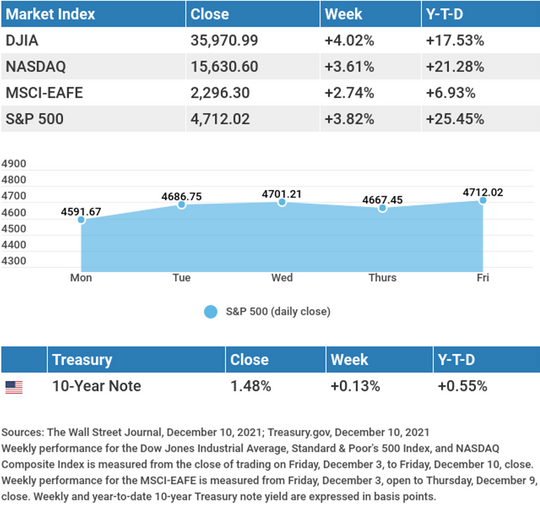

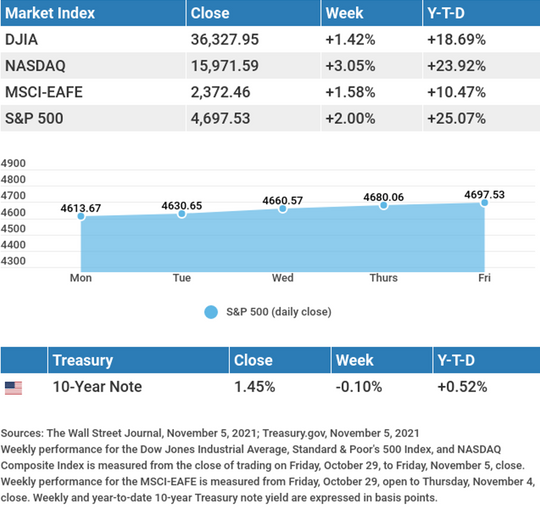

The Dow Jones Industrial Average rose 1.05%, while the Standard & Poor’s 500 gained 1.55%. The Nasdaq Composite index picked up 2.38% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, tacked on 2.73%.1,2,3

Earnings in Focus

At the start of the week, stocks extended the previous week’s rally with some high-growth companies leading the move higher. Strong company profits fueled the market the middle of the week, until an earnings disappointment from a mega-cap company took investors by surprise. The earnings miss deflated sentiment as it heightened worries of what it may portend for other technology companies yet to report. These anxieties led to a sell-off that reverberated across the market.

Subsequent earnings beats from several technology and social media names, and an above-consensus rise in new payrolls on Friday, helped the market close with week with a solid gain.

Omicron and Unemployment

A string of employment reports pointed to a generally healthy labor market, despite the Omicron surge late last year. The Job Openings and Turnover Survey (JOLTS) showed a hiring slowdown, with near-record high job openings and worker resignations. The ADP (Automated Data Processing) employment report saw private payrolls shrink by 301,000. That was the first monthly decline since December 2020.4,5

More encouragingly, initial jobless claims declined, while continuing jobless claims reached their lowest level since 1973. A strong January employment report showed 467,000 jobs added during the month, with upward revisions to previously released November and December.6,7

Robert Roman

CEO, Managing Director

Louis Barajas

Partner

THIS WEEK: KEY ECONOMIC DATA

Thursday: Consumer Price Index (CPI). Jobless Claims.

Friday: Consumer Sentiment.

Source: Econoday, February 4, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Monday: Amgen, Inc. (AMGN).

Tuesday: Pfizer, Inc.(PFE), Chipotle Mexican Grill, Inc. (CMG), Sysco Corporation (SYY).

Wednesday: CVS Health Corporation (CVS), The Walt Disney Company (DIS), Twilio, Inc. (TWLO), Yum Brands, Inc. (YUM), O’Reilly Automotive, Inc. (ORLY).

Thursday: Twitter, Inc. (TWTR), The CocaCola Company (KO), Illumina, Inc. (ILMN), Duke Energy Corporation (DUK), PepsiCo, Inc. (PEP), Kellogg Company (K), Expedia Group, Inc. (EXPE).

Friday: Dominion Energy, Inc. (D).

Source: Zacks, February 4, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“Keep some room in your heart for the unimaginable.”

– Mary Oliver

Did You Know That You Have the Right to Challenge the IRS?

As a taxpayer, you have the right to challenge the IRS’ position. This is part of the Taxpayer Bill of Rights, which outlines your fundamental rights when working with the IRS.

With this right, you can:

- Raise objections to an IRS decision

- Provide additional documentation in response to proposed or formal IRS actions

- Expect the IRS to deliver a timely objection

- Have the IRS consider any supporting documentation promptly and fairly

- Receive a response from the IRS if they disagree with your position

In some circumstances, you may have the opportunity to have a hearing before an independent Office of Appeals.

* This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov8

Zero-Waste Grocery Shopping Tips

There are many ways to have an eco-friendly shopping trip at the grocery store. Here are a few tips to reduce plastic usage and aim for a zero-waste trip to the store:

- When possible, buy your dry goods from the bulk bin. This saves on plastic packaging compared to the ready-made items in the aisles.

- Not only can you bring your bags, but you can also bring your bulk containers, jars, or bulk bags.

- If you can’t shop in bulk bins, look for dry goods or produce in aluminum cans, which are easier to recycle.

- Paper or glass are also better for the environment than plastic. Choose eggs and milk that are in cardboard containers.

- If you have to buy a plastic container of something, buy the biggest size available because it will last longer and will use less packaging.

Tip adapted from Green Matters9

They never move, even when we walk on them, but signs and arrows may indicate that they go “up” and “down.” What are they?

Last week’s riddle: Two children are born in the same hospital (and in the same hospital room) in the same year, month, day, and minute. They have the same two parents, yet they are not twins and have no brothers. How is this possible? Answer: They are sisters, and their mother had triplets (all girls).

Field of sunflowers (Helianthus annuus) on the island of Noakhali, South-eastern Bangladesh.

Footnotes and Sources

1. The Wall Street Journal, February 4, 2022

2. The Wall Street Journal, February 4, 2022

3. The Wall Street Journal, February 4, 2022

4. The Wall Street Journal, February 1, 2022

5. CNBC, February 2, 2022

6. CNBC, February 3, 2022

7. CNBC, February 4, 2022

8. IRS.gov, September 1, 2021

9. Greenmatters.com, November 19, 2020

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2021 FMG Suite.