Stock prices dropped last week as hopes for a fiscal stimulus bill faded and investors focused on rising COVID-19 infections, here and abroad.

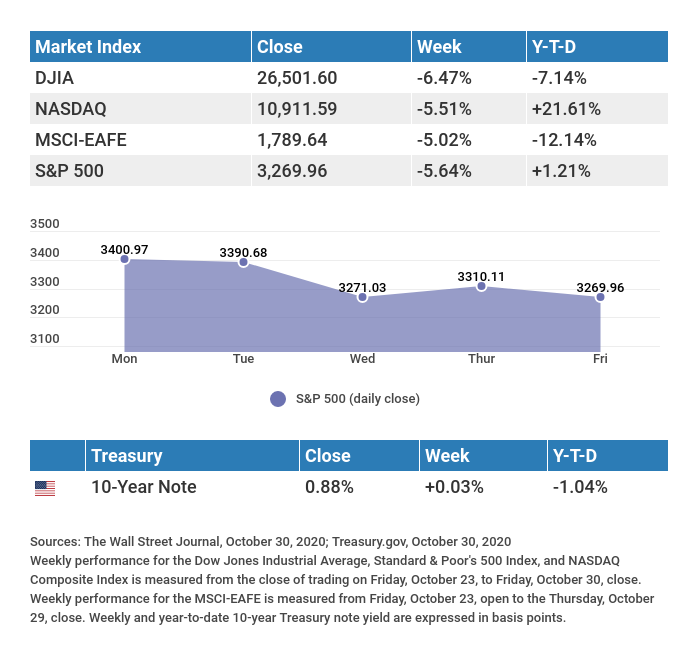

The Dow Jones Industrial Average slid 6.47%, while the Standard & Poor’s 500 tumbled 5.64%. The Nasdaq Composite index lost 5.51% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, slumped 5.02%.[i],[ii],[iii]

A Difficult Week for Stocks

Stocks opened the week lower as lawmakers failed to pass a fiscal stimulus bill and a pick up in the number of new COVID-19 cases in the U.S. and Europe. Hardest hit were companies most exposed to pandemic-related economic impacts, including energy, travel and leisure, and industrials.

Losses accelerated mid-week on reports of rising coronavirus-related hospitalizations, along with news that Germany and France were reinstating partial shutdown restrictions.[iv]

Stocks attempted to recover on Thursday, but took another leg lower on Friday as earnings reports from the mega-cap technology companies failed to impress investors.

Positive Economic News

There were several strong economic reports during the week, but investors paid little attention. Among the highlights were durable goods orders, which rose for the fifth consecutive month, a sharp drop in initial jobless claims that were the lowest since March 14th, and a 33.1% annualized jump in economic growth during the third quarter.[v],[vi],[vii]

Investors also ignored a strong start to earnings season, which has seen 85% of reporting companies in the S&P 500 index beating earnings estimates by an average margin of 19%.[viii]

Robert Roman

CEO, Managing Director

THIS WEEK: KEY ECONOMIC DATA

Monday: ISM (Institute for Supply Management) Manufacturing Index.

Wednesday: ADP (Automated Data Processing) Employment Report. ISM (Institute for Supply Management) Services Index.

Thursday: Jobless Claims. FOMC (Federal Open Market Committee) Meeting Announcement.

Friday: Employment Situation.

Source: Econoday, October 30, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Monday: Paypal Holdings (PYPL), The Clorox Company (CLX), Mondelez International (MDLZ), Eversource Energy (ES)

Tuesday: Humana, Inc. (HUM), Prudential Financial (PRU), Emerson Electric (EMR)

Wednesday: Qualcomm (QCOM)

Thursday: Alibaba Group (BABA), Square, Inc. (SQ), Bristol Myers Squibb (BMY), General Motors (GM), Duke Energy (DUK), Cigna Corp. (CI), T-Mobile:US (TMUS), Booking Holdings (BKNG), MetLife (MET)

Friday: CVS Health Corp. (CVS), Marriott International (MAR)

Source: Zacks, October 30, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“You have succeeded in life when all you really want is only what you really need.”

– Vernon Howard

Know the Signs of an IRS Phone Scam

Unfortunately, criminals often use the IRS as a gateway for common phone scams. These scams can differ, but they generally include someone posing as an IRS agent asking for payment. These calls can be scary, especially if you don’t know what to believe.

Here are some signs of a phone scam so you can recognize them and report them to the IRS immediately:

- Generally, the IRS will first try to reach you by mail if you owe money. If you haven’t received any previous notice, the call might be fraudulent.

- The IRS will never ask about personal information over the phone, such as your Social Security Number.

- The IRS will also never request immediate payment using specific payment methods such as prepaid debit cards, gift cards, or wire transfers.

- The IRS won’t demand that these taxes be paid without giving you the opportunity to ask questions about the amount owed.

- The IRS won’t threaten to immediately bring in law enforcement groups to have you arrested for not paying.

If you receive these scam calls, hang up immediately and report the call to the IRS using the IRS Impersonation Scam Reporting form or by calling 800-366-4484.

* This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS[ix]

Examine Your Spine Angle at Address

Your posture is one of the most important parts of your golf swing. Included in your posture is your spine angle at address and here, we share some tips on how to achieve the perfect angle to maximize your rotation.

Every golfer’s swing is going to be a little different depending on your unique body type and flexibility, but generally you should have a slight arch at your pelvis to create a straight spine. Many golfers hunch their shoulders into more of a “C” posture or are too extended, which can cause issues with your rotation. Instead, focus on a straight line going from your hips through your back and shoulders.

A simple drill to test whether or not you have the correct spine angle is to put a golf club along your spine and see if you can easily fit your hand between the club and your back. It should be a snug fit. If there’s too much space or two little space, your spine angle might be off.

Tip adapted from Golf Distillery[x]

The Mental and Physical Benefits of Walking

We all know the many potential benefits of exercise, but did you know that sometimes the simplest exercises are some of the most beneficial? Walking might seem like such a simple thing to do, but there are many potential health benefits to this form of exercise.

First off, walking has a very low barrier of entry and may be a good choice for people of all fitness levels! You don’t need any fancy equipment or skill level. Just grab your favorite pair of shoes and hit the road!

Secondly, walking may benefit both your mental and physical health. You burn active calories while walking, which can help with weight management, cardio health, and energy levels. But walking may also be a meditative escape for many people. It offers the chance to disconnect and focus on the moment. Walking for the sake of walking is one of the only exercises that doesn’t have an end goal, meaning that you can focus on just putting one foot in front of the other. Some people might enjoy listening to music or podcasts while they walk, but also consider just listening to the sounds around you. With so much screen time in our daily lives, it’s nice to disconnect for even just a short walk.

Tip adapted from Healthline[xi]

The Art of Thrifting

Thrift store shopping is not only fun (think: treasure hunting), but it’s a great way to recycle clothing, housewares, and other items. True, there can be a lot of clutter to sort through, but with a few pro-tips, you’ll be thrifting with the best of them.

Upcycle. You might just find that perfect denim jacket or pair of jeans to embroider, bedazzle, or alter, creating an entirely new look. Furniture can be transformed and upcycled to make into functional (and stylish) decor. Pinterest is a great resource for upcycling ideas.

Location, location, location. You may be tempted to go to more upscale neighborhoods, but you never know where you’ll score great stuff, so try varying where you scout.

When you thrift makes a difference. Skip Halloween and back-to-school time. The stores are usually picked over.

Know when to fold ‘em. Say no to sweat-stained and odor-laden clothing, and definitely, say no to moth holes. A bit of sewing, or even, springing for new soles on a pair of amazing shoes, is doable – and worth it.

Tip adapted from Elle Magazine[xii]

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indices from Europe, Australia, and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Strategies, LLC, and not necessarily those of the named representative,

Broker dealer or Investment Advisor and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial professional for further information.

The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

[1] The Wall Street Journal, October 30, 2020

[2] The Wall Street Journal, October 30, 2020

[3] The Wall Street Journal, October 30, 2020

[4] CNBC, October 27, 2020

[5] The Wall Street Journal, October 27, 2020

[6] CNBC, October 29, 2020

[7] The Wall Street Journal, October 29, 2020

[8] CNBC, October 29, 2020

[9] IRS.gov, March 9, 2020

[10] Golfdistillery.com, October 30, 2020

[11] Healthline.com, October 30, 2020

[12] Elle.com, October 30, 2020