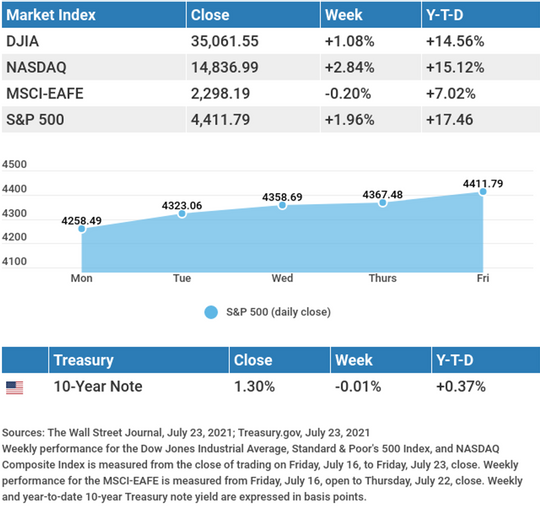

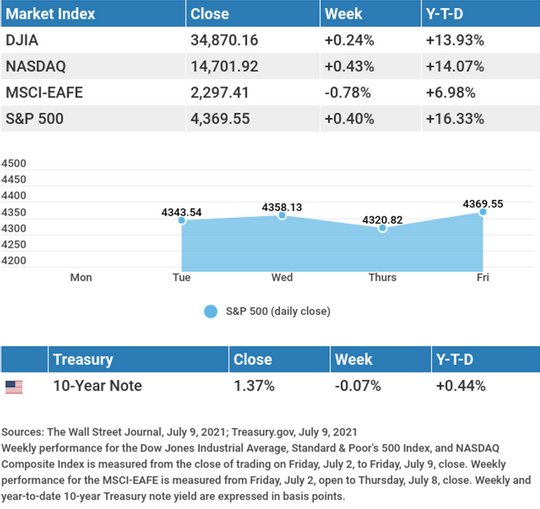

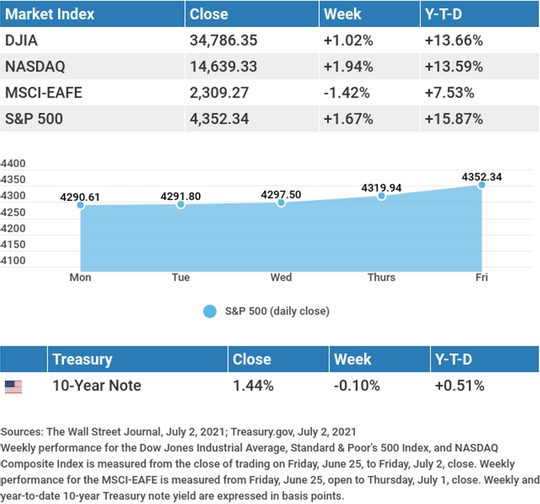

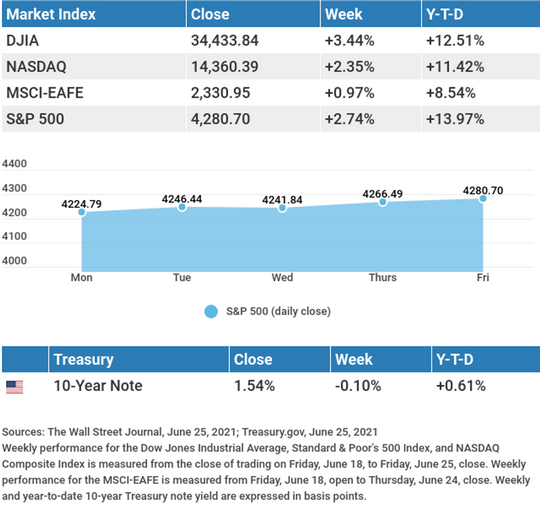

The stock market powered to record levels last week amid talk of Fed tapering and a deceleration in new Delta variant cases.

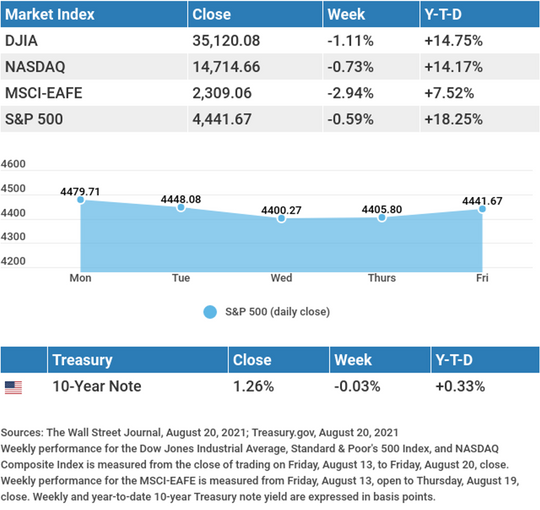

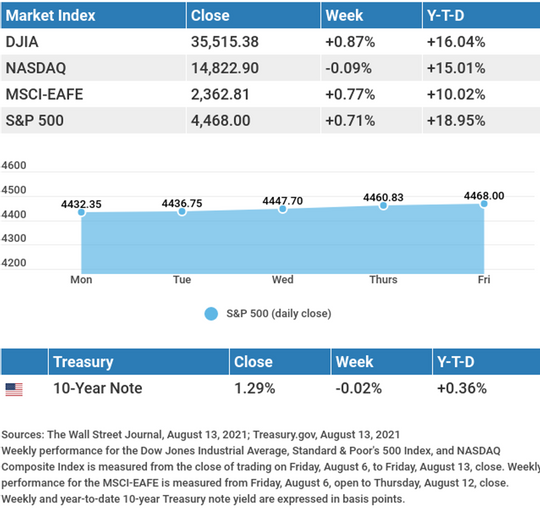

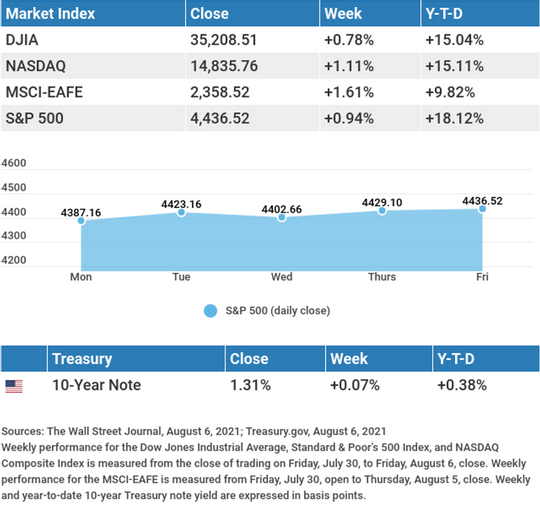

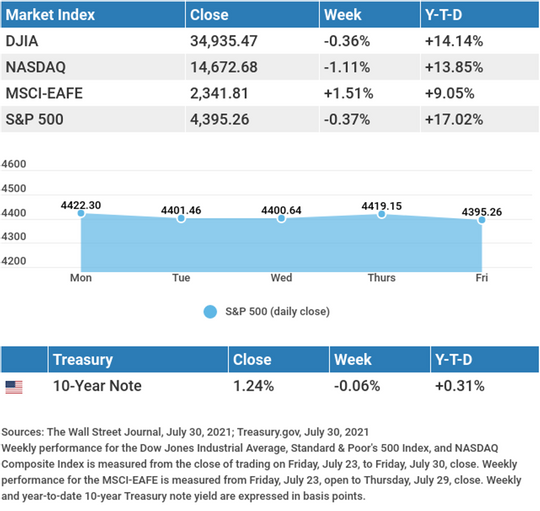

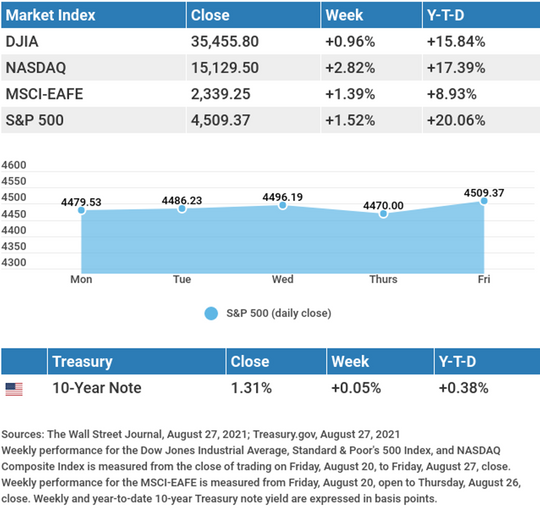

The Dow Jones Industrial Average gained 0.96%, while the Standard & Poor’s 500 increased 1.52%. The Nasdaq Composite index led, picking up 2.82%. The MSCI EAFE index, which tracks developed overseas stock markets, rose 1.39%.1,2,3

Pushing Higher

Stocks surged to begin the week as investor sentiment improved on news of the FDA’s approval of its first COVID-19 vaccine, a strong housing number and comments by the Federal Reserve Bank-Dallas president that he would support delaying tapering if the Delta variant spread worsened.

Stocks continued their climb through midweek, pushing the S&P 500 to another record high and the NASDAQ Composite above 15,000 for the first time. The S&P 500 and NASDAQ Composite closed the week at record highs following Fed Chair Powell’s comments that Fed is likely to begin winding down its monthly bond purchases (aka tapering) by year-end, though no interest rate hikes were imminent.4

Powell Speaks

At last week’s Jackson Hole Economic Policy Symposium, Fed Chair Jerome Powell’s speech on Friday provided further insights into Fed plans to begin tapering. Powell said that the Fed may likely commence tapering prior to year-end, adding that the wind down of bond purchases should not be seen as a signal for future rate hikes. Powell emphasized that labor market conditions remain short of the Fed’s target for maximizing employment. He also reiterated his case for why inflation remains a transitory phenomenon.4

With a number of Regional Federal Reserve Bank presidents already supportive of tapering, investors may see more definitive steps coming out of next month’s FOMC (Federal Open Market Committee) meeting.

Robert Roman

CEO, Managing Director

Louis Barajas

Partner

THIS WEEK: KEY ECONOMIC DATA

Tuesday: Consumer Confidence.

Wednesday: ISM (Institute for Supply Management) Manufacturing Index. ADP (Automated Data Processing) Employment Report.

Thursday: Jobless Claims. Factory Orders.

Friday: Employment Situation Report. ISM (Institute for Supply Management) Services Index.

Source: Econoday, August 27, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Monday: Zoom Video Communications, Inc. (ZM).

Tuesday: Netease, Inc. (NTES), Crowdstrike Holdings (CRWD).

Wednesday: Okta, Inc. (OKTA).

Thursday: Broadcom, Inc. (AVGO), Mongodb, Inc. (MDB), Docusign, Inc. (DOCU).

Source: Zacks, August 27, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“What you do makes a difference, and you have to decide what kind of difference you want to make.”

– Jane Goodall

Is it Time for a Paycheck Checkup?

There’s no better time to check your withholding status and make sure your paycheck accurately reflects the taxes you should be paying. These paycheck checkups are a great practice when something happens in your life that may change your tax status, such as getting married or getting divorced, having a baby, getting a new job, or getting a raise or promotion at work. You can also adjust your withholding status if you just want to change how much tax is withheld due to other circumstances.

During your paycheck checkup, you can also check other factors such as how much you’re contributing to your health insurance or 401(k). These expenses can also impact your tax liability.

* This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov5

5-Minute Core-Strengthening Workout

Even if you don’t have a ton of time to dedicate to a core workout, this circuit will get you going and only takes 5 minutes. Here are the moves:

- 1-minute high plank: Your hands are on the ground, your arms are straight, and you are holding your body up with your arms and a tight core.

- 30-second side plank on each side: One hand is on the ground, your arm is straight, and the other arm is in the air. You can do a side plank with your feet stacked on top of each other (hardest), your feet staggered (a little easier), or your bottom knee on the ground.

- 1-minute boat pose: Your feet are in the air and your arms are by your side reaching to your feet. You can do this pose with your legs bent (easier) or straight out (harder).

- 1-minute crunches: Lift your shoulders and upper back off the ground without pulling your neck.

- 1-minute dead bug: Lay on your back and alternate extending out the opposite arm and the opposite leg at the same time.

Tip adapted from Mind Body Green Movement6

The more you take away, the bigger I become. What am I?

Last week’s riddle: Aaron is the brother of Bob. Bob is the brother of Cody. Cody is the father of Dan. So how is Dan related to Aaron? Answer: Aaron is Dan’s uncle.

Footnotes and Sources

1. The Wall Street Journal, August 27, 2021

2. The Wall Street Journal, August 27, 2021

3. The Wall Street Journal, August 27, 2021

4. CNBC, August 27, 2021

5. IRS.gov, September 19, 2020

6. Mindbodygreen.com, November 2, 2019

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2021 FMG Suite.