Deteriorating investor enthusiasm for high-valuation growth companies and a mixed start to the fourth-quarter earnings season made for a volatile week.

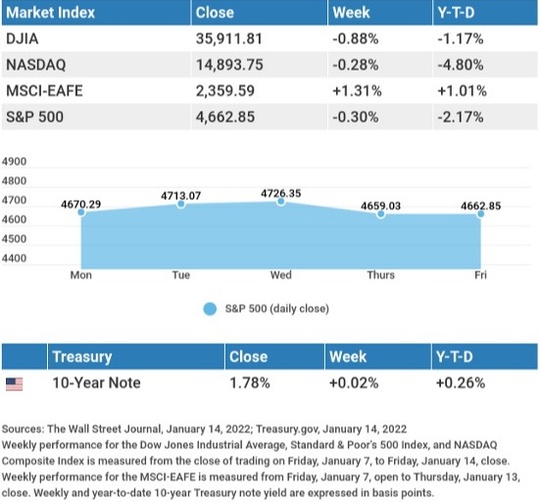

The Dow Jones Industrial Average lost 0.88%, while the Standard & Poor’s 500 slipped 0.30%. The Nasdaq Composite index fell 0.28% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, gained 1.31%.1,2,3

Stocks Struggle

Stocks were under pressure all week as investors grappled with higher bond yields and talk of possibly four rate hikes this year. Initially, intraday declines would bring out buyers and pare the losses. Investors were particularly heartened by Fed Chair Powell’s congressional testimony on Tuesday that softened the hawkish tone found in the minutes of the Federal Open Market Committee’s December meeting.

After digesting the hot inflation reports released mid-week, stocks were unable to resist the selling pressures on Thursday. A weak retail sales number, a resumption in the rise in yields, and mixed earnings from some of the big money center banks weighed on the market during Friday’s trading.

Inflation and the Fed

Inflation reports last week continued to reflect upward momentum in consumer prices. The Consumer Price Index posted a 7.0% year-over-year jump–the biggest increase since 1982, while the Producer Price Index rose 9.7% from a year earlier–the fastest pace since 2010 when the index was reconstituted.4,5

Markets responded calmly as both numbers were in the neighborhood of expectations and the monthly increase for each moderated from previous single-month increases. The price pressures are expected to remain in the face of continuing supply chain constraints and wage growth. The pace and persistence of price increases may influence the speed at which the Fed may tighten in the year ahead.

Robert Roman

CEO, Managing Director

THIS WEEK: KEY ECONOMIC DATA

Wednesday: Housing Starts.

Thursday: Jobless Claims. Existing Home Sales.

Friday: Index of Economic Indicators.

Source: Econoday, January 14, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Tuesday: The Goldman Sachs Group, Inc. (GS), The Charles Schwab Corporation (SCHW), J.B. Hunt Transport Services, Inc. (JBHT)

Wednesday: Bank of America (BAC), UnitedHealth Group, Inc. (UNH), The Procter & Gamble Company (PG), Morgan Stanley (MS)

Thursday: Netflix, Inc. (NFLX), CSX Corporation (CSX), Union Pacific Corporation (UNP), United Airlines Holdings, Inc. (UAL)

Friday: Schlumberger Limited (SLB).

Source: Zacks, January 14, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“If we all worked on the assumption that what is accepted as true were really true, there would be little hope of advance.”

– Orville Wright

What to do if You Get Mail From the IRS

The IRS sends letters and notices for many different reasons. Some letters need a response or action item, while some are just notices to keep you informed.

Here’s what to do if you receive mail from the IRS:

- Don’t throw it away.

- Don’t panic.

- Don’t reply unless directed to do so.

- If a response is needed, respond in a timely manner.

- Review the information to make sure it’s correct.

- Respond to a disputed noticeIf you need to call the IRS, use the phone number printed in the upper right-hand corner of the notice.

- Avoid scams through email, social media, or text messages.

* This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov6

A Stretch to Combat “Tech Neck”

We spend so much time staring at our phones and computers, it’s no wonder that so many of us are suffering from “tech neck,” or a muscle tightness at the back of the neck from looking down for multiple hours of the day.

Luckily, there are quite a few stretches you can do to combat tech neck. Here is one of our favorites:

This stretch is called the exaggerated nod. While sitting at your desk or standing comfortably, slowly look up to the ceiling with your mouth closed. Then, open and close your jaw to feel a stretch in the front of your neck. Repeat this for a few seconds.

After you look up, exaggerate your nod down by staring at your chest. This will help stretch out the back of your neck. Repeat these two stretches a few times to loosen up your tech neck.

Tip adapted from Healthline7

How many times can you subtract the number 4 from 40?

Last week’s riddle: I’m soft enough to soothe the skin, as well as make rocks crumble. I’m often slippery and on the move. What am I? Answer: Water.

Spirit Island, Jasper Alberta, Canada

Footnotes and Sources

1. The Wall Street Journal, January 14, 2022

2. The Wall Street Journal, January 14, 2022

3. The Wall Street Journal, January 14, 2022

4. The Wall Street Journal, January 12, 2022

5. CNBC, January 13, 2022

6. IRS, August 16, 2021

7. Healthline.com, September 30, 2021

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2021 FMG Suite.